Whether you are a first-time buyer, buying a new house or investing in a dream residence, sometimes you’ll need additional finance for achieving your goals. Srihita Constructions can help you make your dream come true.

Right now we are having direct contacts with SBI Home Finance, HDFC, LIC Home Finance, ICICI, GIC Home Finance, Canfin Home Finance, & Aditya Birla Home Finance. Very soon, we can able to provide support from other Banks which are PNB Bank & Andhra Bank.

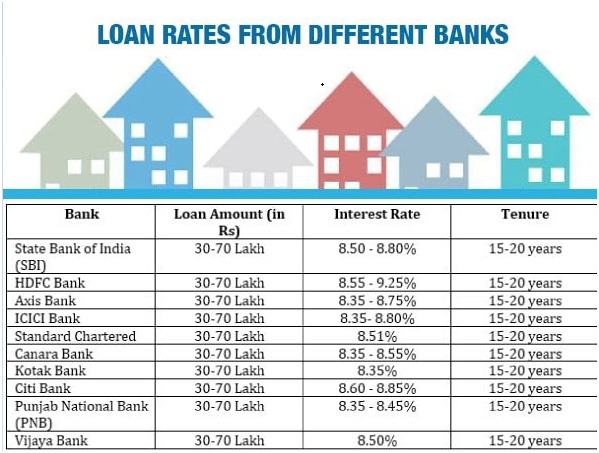

Housing Loan Interest Rates as on Nov, 2019

List of Documents required for smooth Housing Loan process:

• Photo

• Pan card

• Aadhar Card

• Present Resident proof (Aadhar,Voter I'd, Bank statement, Gas Bill)

• 3months’ Payslips

• 6 months Bank statement

• Latest year Form-16

• Company Id card

• One cheque from your Salary account

• If have any loans provide Loan Tracks

• 0.5% mod charges applicable at the time of Registration.

• Property documents. Plan and proceedings, sale deed

Income Tax Exemption:

Yes, home loan principal is part of Section 80C of the Income Tax Act. Under this section, an individual is entitled to tax deductions on the amount paid as repayment of the principal component on the housing loan. An amount up to Rs. 1.50 lakh can be claimed as tax deductions under Section 80C.